Industrial development reaching new heights and spurring new hubs across DFW

Construction of industrial warehouses and distribution facilities is booming across the state of Texas and Dallas-Fort Worth is leading the way. According to CBRE’s recent 2022 North America Industrial Big Box Report, DFW is the third largest big box market in North America but led the way with close to 50 million square feet under construction in 2021 (with 35.3% pre-leased).

This trend is nothing new for Dallas Fort Worth, which has been one of the leading hubs for industrial development across the state for some time.

Sustained growth in the DFW industrial sector is unequivocally strong and will be for the foreseeable future, but the size of projects and location of the traditional development epicenters is adjusting to market conditions. Specifically, industrial development across the DFW metroplex is not only gravitating towards established hubs, but is spawning increased investment in new and maturing hubs as well.

The predominate hubs of South Dallas, DFW airport, South Fort Worth, and Alliance continue to be attractive and still have some land within reach (although typically at price points of $4 to 5 per foot), but infill sites like Valwood, GSW (Great Southwest) and Lewisville are rapidly running out of prime real estate. Of the land that is left, it tends to be encumbered with environmental challenges. According to Liam Logan, director of investments with Core5 Industrial Partners, “The most attractive geographic areas are still infill sites, close to population clusters, or sites with great access to major thoroughfares. However, the most active geographic areas are South Dallas, South Fort Worth, and North Fort Worth.” According to NAIOP’s recent 2022 National Investment Industrial Forecast, “The strongest net absorption has been along Interstate 35 in Tarrant Coun¬ty, as well as South Dallas.”

Beyond these industrial epicenters, developers are driving demand outside of traditional core industrial zones with major industrial investments evident in cities such as McKinney, Forney, Burleson, Midlothian, Denton, Mesquite, and other “outlier” areas. A recent industrial report published by Holt Lunsford Commercial echoed this sentiment, “We are seeing development span to new areas of the metroplex as large entitled industrial sites are becoming more scarce and the institutional demand continues to increase as capital markets flee other product types and follow the increasing demand from industrial occupiers.”

In line with the burgeoning population and business growth across the state of Texas, an influx of new industrial development firms has also been driving additional investment. Logan added, “We have nearly double the number of active developers in DFW that we saw three to five years ago.” Beyond this, the low cost of money and the business-friendly environment that Texas offers continues to attract unprecedented investment in the industrial sector.

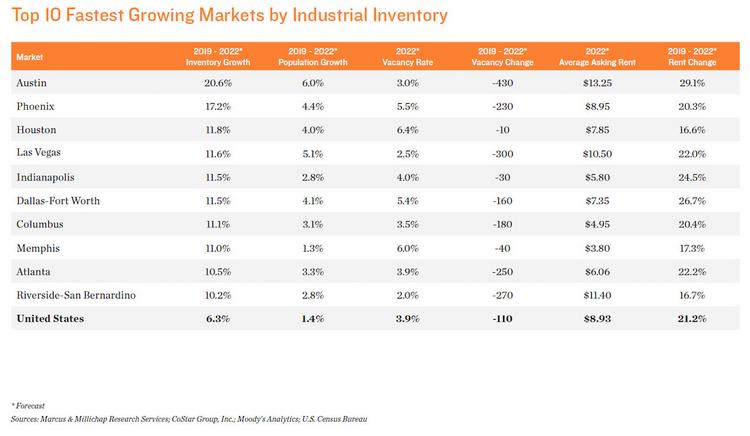

These sustained market dynamics have created an environment where the deals are getting bigger. Per a recent National Investment Forecast by Marcus and Millichap, “Approximately 420 million square feet of industrial space will be delivered this year, with developers focusing on larger properties.”

Specific to the DFW metroplex, there are several benefits driving enhanced development of larger projects, such as population growth, corporate relocations, and local transportation infrastructure – including established airport and intermodal hubs – which are all appealing to national distributors. These fundamentals are supporting stronger demand for leases in excess of 100,000 square feet. “The big trend has been the acceleration of demand for big-box space,” said Tom Pearson, executive vice president with Colliers. “The increased demand for e-commerce due to the pandemic and the flood of container imports hitting the U.S. shores requires larger warehouses to store more products.

“The whole restructuring of the economy – based on the pandemic in part – has really changed our buying habits – hence buying products online and having them delivered to our doorstep,” said Pearson. “I don’t see our business really slowing down right now in Dallas. My main concern is supply of enough land to keep up with the demand for warehouse and manufacturing space. DFW is on everybody’s radar.”

Source: Dallas Business Journal